how to calculate cash assets

Or Quick Ratio Current Assets Inventory Current Liabilities. Calculating total assets sounds like a massive undertaking but its actually relatively simple.

Interval Measure Meaning Importance How To Calculate Burn Rate And Defensive Interval Ratio Financial Management Financial Ratio Financial Health

When you are trying to determine whether you have enough current assets your first step is to add up those assets as a basis for comparison.

. The common size percent for cash formula requires you to take the amount and divide it by the base amount before multiplying it by 100 percent. Total cash invested 200000 20000 220000. And determine each items.

In the above total assets formula non-current assets are Land Buildings Machinery otherwise known as fixed assets. Total Assets 1000000600000500000350000200000100000. Current assets cash cash equivalents inventory accounts receivable marketable securities prepaid expenses other liquid assets.

How to Calculate Total Assets. In this case the amount is the cash and the base amount is the total assets a company owns. Cash and cash equivalents include instruments that can be converted into cash in three months or less.

Operating cash flow is equal to revenues minus costs excluding depreciation and. Cash to Current Assets Ratio Cash Cash Equivalents Marketable Securities Total Current Assets The numerator of the formula represents the value of the most liquid assets of a company. To calculate a companys current assets you can use the following formula.

Start by listing out all your assets everything of value that you own such as televisions collectibles cash houses etc. Collect the market value of all your assets. Thus the total cash invested is calculated by.

Cash Return on Total Assets Ratio Operating Cash Flow Average Total Assets. 24000 -10000 2000 16000. But you can use the formula for all the line items on any company balance sheet.

Current Assets Cash Cash Equivalents Inventory Accounts Receivables Marketable Securities Prepaid Expenses Other Liquid Assets. Total Assets Land Buildings Machinery Inventory Sundry Debtors Cash Bank. C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s.

Cash flow from operations. Subtract the amount of noncash current assets from total current assets to calculate the companys cash balance. The cash asset ratio is calculated by dividing the sum of cash and cash equivalents by current liabilities.

This results in the following cash flow from assets calculation. As a reminder use the following formula to find your total current assets. So the calculation of total assets can be done as follows.

Current assets cash and equivalents accounts receivable inventory short-term investments prepaid expenses other liquid assets. When calculating the ratio the first thing you need to do is look for each component in the current liabilities and current assets section of the balance sheet. Cash Flow on Total Assets Ratio Formula.

Add the three amounts to determine the cash flow from assets. How to calculate average active assets. You can follow these steps to measure a companys non-cash working capital using its current assets.

Is the net cash flow from operating activities in the statement of cash flow. Total cash invested Down payment Fees. If you want to calculate the average operating cost for a company you can use the formula.

Here is the formula for current assets. Annual cash flow 120000 30000 90000. Calculate your current assets.

In this example subtract 125000 from 200000 to get 75000 in. Operating assets OA Cash assets Total accounts receivable Prepaid expenses Total PPE Tangible assets Intangible assets Follow these steps to calculate a companys active assets. The formula is as follows.

This is the amount that the company spent on the investment excluding the leverage. You can calculate the average total assets by summing the beginning and ending total assets and then dividing the result by 2 as follows. This is a positive cash flow.

Current Assets 6000 500 1000 2000 200 2000. Quick Ratio Cash Cash Equivalents Investments Short-term Accounts Receivable Existing Liabilities. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following.

The companys cash flow from assets may indicate to buyers that purchasing the company is a good value. Johnson Paper Companys cash flow from assets for the previous year is 16000. Your total current assets for the period are 11700.

Operating cash flow capital spending and change in net working capital. Average Total Assets Beginning Total Assets Ending Total Assets 2. Operating cash flow is the cash generated from a firms normal business activities.

Cash Asset Ratio Cash Cash Equivalents Current. Then we must find out the total cash invested. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Debt To Equity Ratio Balance Sheet Being A Landlord

Capital Calculator Use The Capital Calculator To Calculate Your Working Capital Including Liquid Assets And Liabi Spreadsheet Template Spreadsheet Calculator

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Cash Flow Statement Learn Accounting

Daily Cash Sheet Template Download Excel Sheet Raising Capital Cash Templates

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy In 2022 Balance Sheet Check And Balance Debt To Equity Ratio

Financial Capital Structures Define Leverage Owner Lender Risks Business Risk Financial Cost Of Capital

What Is My Net Worth And How Do I Calculate It Net Worth Investment Accounts Finance

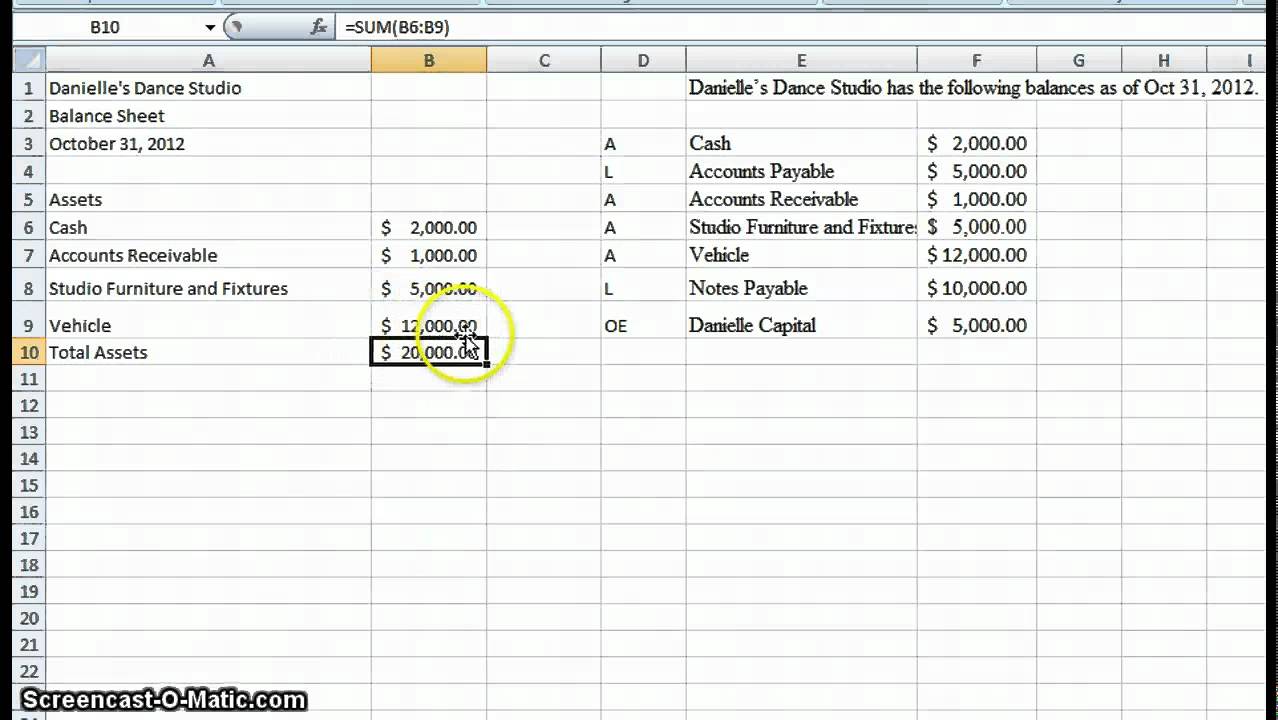

Create A Simple Balance Sheet Balance Sheet Template Excel Spreadsheets Balance Sheet

Free Net Worth Calculator For Excel Personal Financial Statement Net Worth Statement Template

Personal Net Worth Calculator Excel Spreadsheet Asset Debt Tracker In 2022 Personal Finance Net Worth Spreadsheet

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Studywalk Cash Cycle Cash Turnover Inventory Turnover Efficiency Ratios Asset Turnover Ratio Studywalk Gmail Inventory Turnover Cost Accounting Finance

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Balance Sheet Current Year Calculator Use The Balance Sheet Calculator To Calculate Spreadsheet Template Balance Sheet Template Personal Financial Statement

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Small Business Bookkeeping

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management